How to pass on the credit cards fees

Why is the Credit Card Surcharge helpful?

- The YouLi Platform offers 5 different payment methods including credit card.

- The most popular method is credit card!

- Credit Card payments are extremely convenient for travelers and can be initiated via Stripe or Square on any YouLi subscription. However, using a credit card can be expensive for Trip Planners as there is a (merchant) fee added to credit card transactions. The Traveler doesn't see this, but the planner certainly does!

How to Set Up Credit Card Surcharge

To pass the fee onto the traveler: add a SURCHARGE % to the Credit Card option under TRIP COSTS. (just click the price in the header of your trip)

NOTE: Co-Planners on trips cannot edit TRIP COSTS, so it must be changed by the Trip Owner or Team Member.

What is a Surcharge?

- A SURCHARGE is a percentage of the payment added to the invoice when a Traveler selects Credit Card (or any of your Stripe payment methods, if you have those set up!) as their payment method. This is NOT added to any of the fee-free payment options.

WARNING: If you have set a Surcharge on your Trip, it will charge on any Stripe payment methods that you set up (for example ACH). It's a Stripe Surcharge, not a credit card Surcharge.

- The Surcharge is an extra fee added to a Traveler's invoice, dynamically, when they choose to pay with a credit card or an alternative Stripe payment method.

- In the example below, if the TRIP DEPOSIT is $400, and the surcharge is set to 2%, then the Traveler would pay an extra $8 if they select credit card as their payment method.

- If they select to pay via bank transfer, then the Surcharge will not be added.

NOTE: This may not cover the actual fee charged because Stripe does not provide the fee amount prior to the charge being made - read on for details.

Pass on the Credit Card Fee

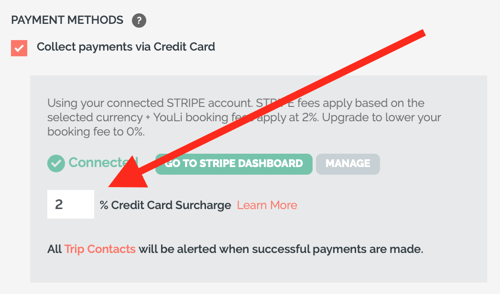

If you have your Stripe account connected, you can choose to pass on the fee as a credit card surcharge.

As a Trip Owner, you'll have to pass on a percentage fee that's as close as you expect it will be.

- Check Stripe Fees for the typical percentage charged in your currency.

- If you are using Square, check their documentation.

IMPORTANT: Some jurisdictions (countries) do not allow merchants (that's Planners in this case) to pass Credit Card fees onto customers (Travelers in this case). The UK and European Union in particular have restrictions. In these cases, it is common to increase your overall price instead.

How do I know what Surcharge to add?

Great question!! There is no perfect answer to this. Because increasing the cost increases the fees you pay to the credit card.

Stripe has this to say about passing on credit card fees to customers:

To include the Stripe fee in the final charge, calculate the gross amount, taking into consideration that increasing the final amount also increases the Stripe fee:

the Stripe fee is a flat fee plus a percentage of the total charge.

The flat fee and the total charge percentage must be factored into the final charge amount to ensure that you receive the desired amount, after Stripe deducts the fee from the charge.

That's a long way to say that there is no simple answer that passes on 100% of the fees.

💲 Here's one way to determine your surcharge:

- Find out the fee your gateway charges (from Stripe or Square)

- let's say 1.75% +30c per transaction

- Consider any additional Booking Fee charged by YouLi

- Add them together to be:

- 2.75%

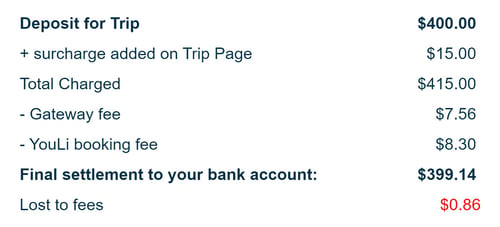

Be aware that you may still lose some money, as indicated in the example below.

🧾Detailed example:

That's still better than losing the full $15.86 in fees.

That's still better than losing the full $15.86 in fees.

You can play with the surcharge to either overcharge or undercharge your traveler depending on your philosophy and the laws governing your business.

NOTE: YouLi's Enterprise clients pay no booking fee, so schedule a sales call to learn about your options!

Example Surcharges Per-Country

This is simply to help guide Planners and is not indicative of actual fees that will be incurred and does not indicate the right to add that surcharge - be sure to check with your legal advisors.

Surcharge Examples: (based on Stripe pricing as of August 2022)

- Australia (AUD): 1.75% (for domestic cards); 2.9% (for international cards).

NOTE: there is a difference between fees on domestic and international cards, but that is not known prior to the charge, so make a guess based on the number of international cards you expect.

- United States (USD): 2.9%; Best to check eligibility based on your state laws

- United Kingdom (GBP): 0% - not allowed under EU law

- European Union (EUR): 0% - not allowed under EU law

- Denmark (DKK): 0% - not allowed under EU law

- Japan (JPY): 3.6%

- Canada (CAD): 2.9%

- New Zealand (NZD): 2.9%

Where do I see the ACTUAL credit card fees?

All this distinction between the Surcharge and the actual fee charged can be confusing. The best way to understand is to add the Surcharge and then see the difference.

There are two ways to see the Surcharge:

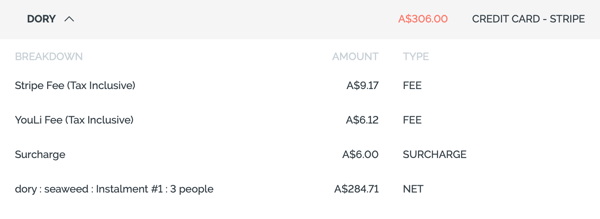

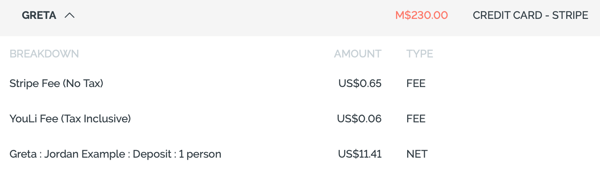

Option 1. Go to your Trip, then click MANAGE PAYMENTS, click to the PAYMENTS report. This will show the Surcharge as a line item so you can compare.

In the example below you can see that the surcharge does not cover the fees collected in this case, so it would be a good idea to increase the surcharge.

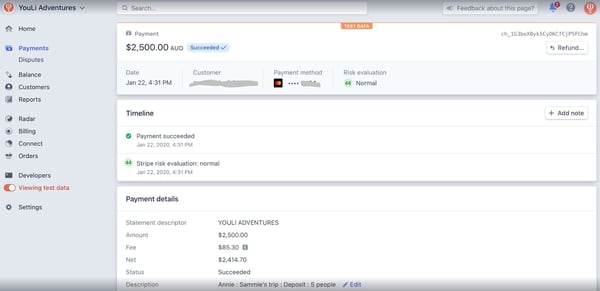

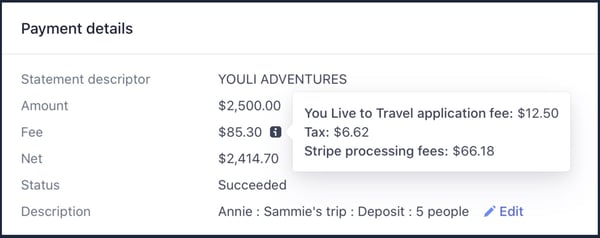

Look at the payment details and hover over the information icon. That will show you the "You Live to Travel" application fee, tax, and stripe processing fees.

If you enable the Surcharge, the extra money you collect will be in the Net amount that settles to your bank account.

Square has a similar interface when accessing their payment dashboard.

How Does the Surcharge Appear in the Traveler Tax Invoice/Receipt?

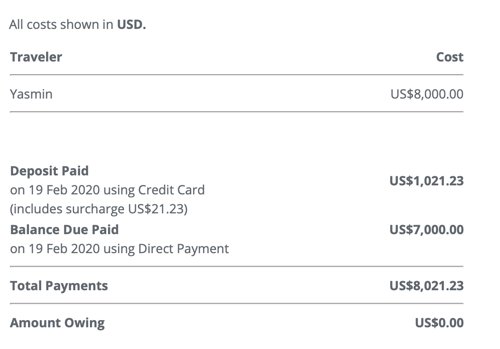

- When the Traveler or you (the Planner), on their behalf, clicks to send a tax invoice/receipt, it will include the Surcharge as part of the payments made.

- In the example below, Yasmin has paid two INSTALLMENTS, one via credit card (including a Surcharge). And one paid directly without a Surcharge.

Need more help?

Schedule a 1:1 Consulting Call and for personalized guidance around the fees and surcharges.